State of the Costa Rican Software Development Environment — 2025 Case Study

Executive Summary

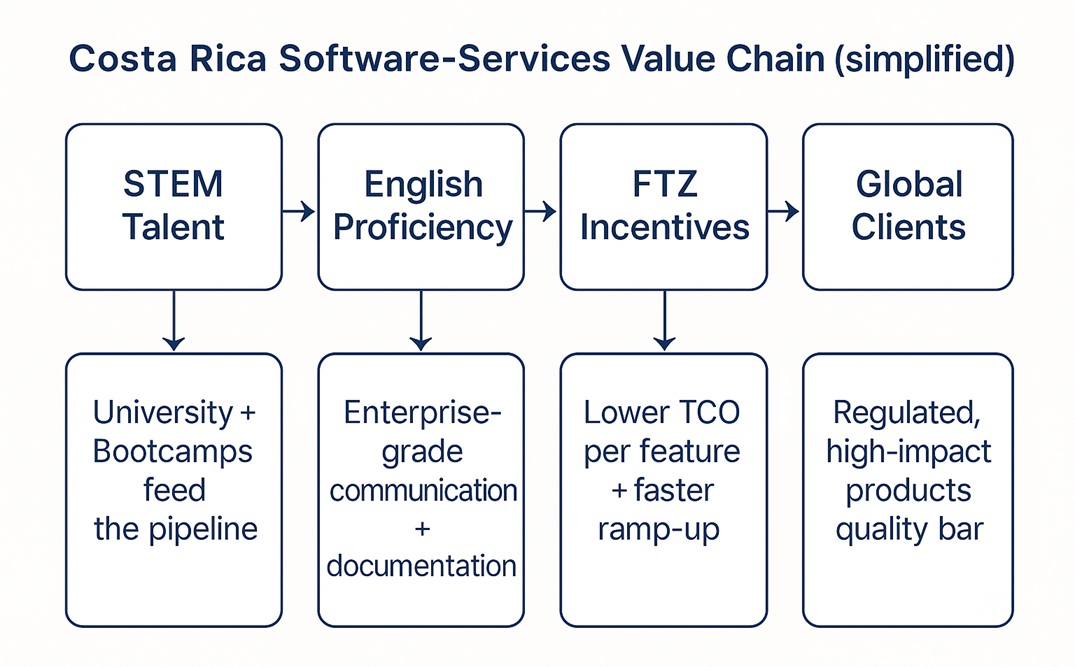

Costa Rica has matured into one of Latin America’s most resilient and sophisticated hubs for software development, advanced services, and life‑sciences manufacturing. The country combines a deep pool of bilingual talent, a stable democracy, a business‑friendly Free Trade Zone (FTZ) regime, and dependable, renewables‑heavy energy with North‑American time‑zone alignment. In 2024–2025 Costa Rica also navigated significant shocks: global demand softness, tariff uncertainty in key export categories, and the announced consolidation/closure of select semiconductor packaging and test operations. Despite these headwinds, the software and knowledge‑intensive services sector remains strong, while life sciences continues to expand.

Key takeaways:

Bilingual talent density: Costa Rica sits among the highest‑proficiency English countries in Latin America, with metropolitan areas like Heredia and San José scoring particularly strong in recent assessments.

Knowledge‑intensive exports: High‑tech and knowledge‑intensive services (IT, cloud, cybersecurity, analytics, and shared services) remain a core engine of FDI and employment creation.

FTZ advantage: The Free Trade Zone regime continues to underpin competitiveness for services and high‑value manufacturing with tax incentives, skills development, and cluster infrastructure.

Life‑sciences momentum vs. semiconductor reset: MedTech keeps setting export records and adding headcount, offsetting the 2025 consolidation of select chip assembly/test lines.

Policy direction: A national AI strategy and 5G spectrum auctions (2024–2025) signal ongoing modernization; a 2023 national cybersecurity strategy addresses resilience after major 2022 attacks.

Who should read this? CTOs, VPs of Engineering, product leaders, and procurement heads evaluating nearshore software development partners should use this report to benchmark Costa Rica’s operating environment and make evidence‑based vendor and location decisions.

Fast Facts (2024–2025)

Population: ~5.3M

Capital: San José

Currency: CRC (colón)

Time zone: Central (CST, GMT‑6) — matches U.S. Central Time most of the year

Electricity mix: ~99% renewables in recent years (hydro, wind, geothermal)

Core export pillars: Medical devices, services (incl. IT/ICT and corporate services), agricultural products

Top software services specializations: .NET and Java ecosystems, modern JavaScript/TypeScript stacks, Python/AI/ML, data engineering/analytics, QA automation (Playwright, Cypress), DevOps/SRE (AWS/Azure), cybersecurity.

1) Talent & Skills Landscape

1.1 English proficiency and cultural affinity

Costa Rica consistently ranks in high English proficiency for Latin America. Metro areas like Heredia and San José post the strongest scores. English‑first service centers, global tech multinationals, and bilingual K‑12 and university programs all contribute to the talent pipeline.

What this means for engineering leaders:

Lower friction across distributed agile teams (clear handoffs, fewer rework cycles).

Faster onboarding for nearshore squads embedded with U.S. product organizations.

Easier rollout of English‑first tooling, documentation, and coding standards.

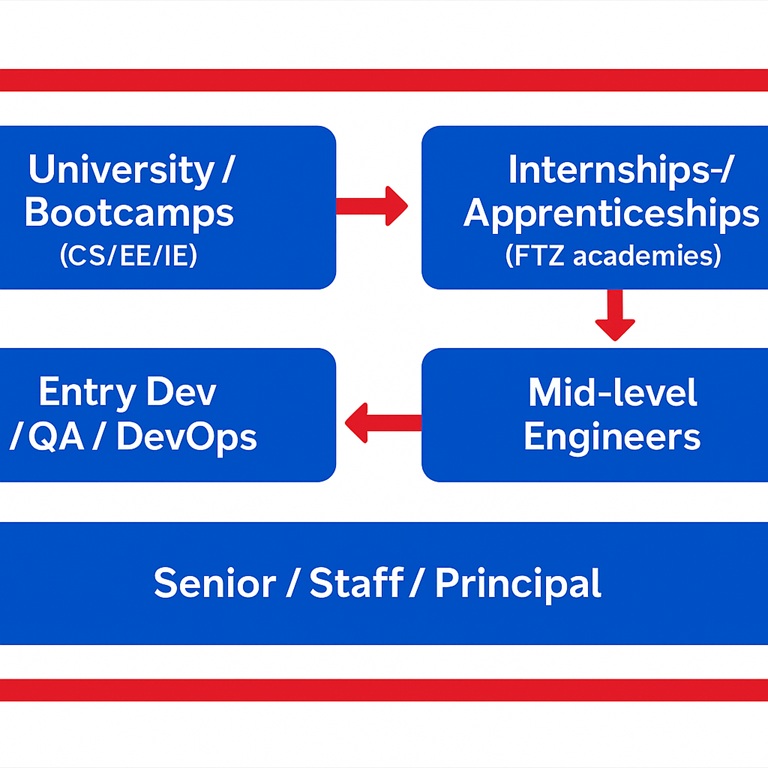

1.2 University & early‑career pipeline

Costa Rica’s university system produces thousands of STEM and business graduates annually (public and private), with strong concentrations in computer science, electronics, industrial engineering, and data/analytics tracks. Combined with robust bootcamp ecosystems and corporate academies (inside FTZ parks), the country’s junior‑to‑mid pipeline is unusually healthy for its population size.

Notable strengths for software teams

Solid foundations in algorithms and data structures from public universities.

Hands‑on exposure to cloud and QA automation through industry partnerships.

Early exposure to bilingual technical writing and Scrum.

1.3 Experience distribution

A typical nearshore candidate distribution we observe for software roles in Costa Rica:

Mid‑level (3–6 yrs): Largest cohort. Comfortable with modern CI/CD, code review, and cloud PaaS (Azure/AWS).

Senior (7–12 yrs): Common in .NET and Java back ends; increasing in Node.js/TypeScript and Python data roles.

Staff/Principal (10+ yrs): Present but competitive; retention and value‑based career paths are key to attract and keep them.

Diagram — Talent Funnel

Hiring note: Bilingual product owners and engineering managers are plentiful relative to peer markets, which helps U.S. teams implement discovery‑to‑delivery loops without adding U.S. headcount.

2) Business Environment & Policy

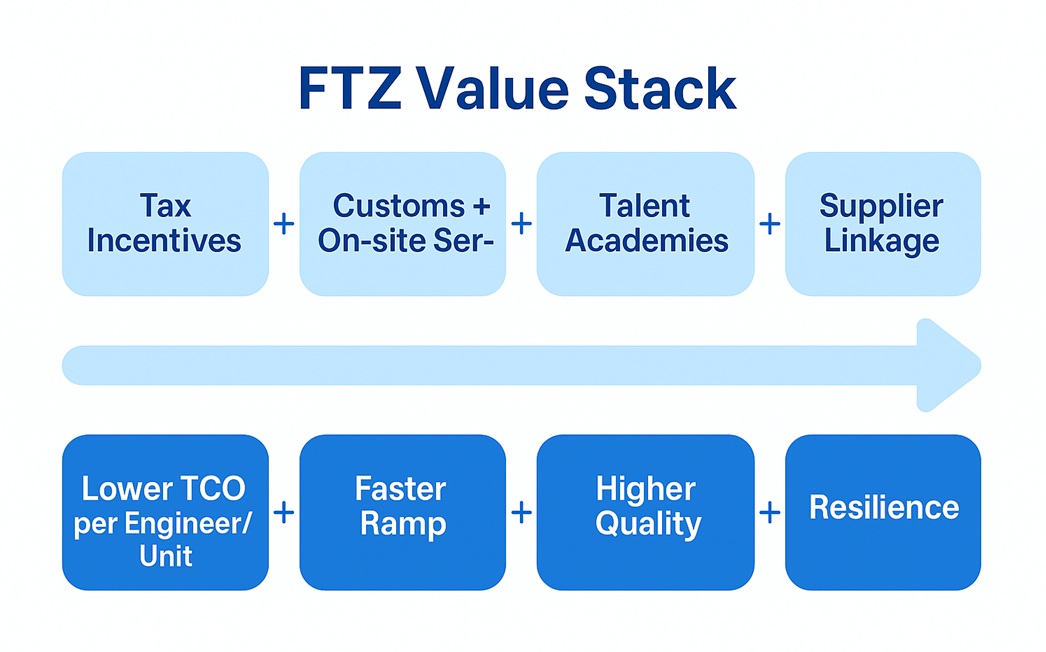

2.1 Free Trade Zone (FTZ) regime

Costa Rica’s FTZ framework underpins both services and advanced manufacturing with competitive incentives, cluster infrastructure, and training programs. The most mature technology campuses (e.g., in Heredia, Alajuela, Cartago) host software, corporate services, and MedTech manufacturing side by side, enabling cross‑functional talent flow.

FTZ Benefits at a Glance

Corporate income tax relief for qualifying periods (phase‑down over time).

Duty exemptions on imports of equipment and inputs for qualified operations.

Streamlined customs and on‑site government one‑stop services.

Strong linkage programs to local SMEs and workforce training.

Diagram — FTZ Value Stack

2.2 Digital & cybersecurity policy

National AI Strategy (2025): Focused on talent, R&D, and adoption in priority sectors; supports public‑private projects and ethical AI frameworks.

National Cybersecurity Strategy (2023): Strengthens institutions and public‑private coordination after the 2022 attacks on multiple agencies.

5G spectrum auctions (2024–2025): Designed to accelerate nationwide coverage and industry use‑cases (edge/IoT).

2.3 Operating costs & value

Costa Rica is not the cheapest nearshore location. However, when factoring English proficiency, time‑zone alignment, tenure/retention, and quality assurance culture, total cost of ownership (TCO) per shipped feature compares favorably, especially for regulated domains (fintech, healthtech, legal, logistics) where defect costs and domain comprehension dominate.

Where Costa Rica shines on value:

Complex product modernization (.NET/Java), cloud refactors, and platform engineering.

QA automation at scale for enterprise web/mobile estates.

Analytics and data pipelines with governance (PII, HIPAA/GDPR awareness).

3) Industry Structure: Software & Advanced Services

3.1 Core software patterns and stacks

Back end: .NET 8/ASP.NET Core, Java (Spring), Node.js/TypeScript.

Front end: React/Next.js, Angular; enterprise design systems; Playwright/Cypress tests.

Data/AI: Python, Spark/Databricks, dbt, ML Ops on Azure/AWS; growing GenAI pilots.

Cloud/DevOps: AWS and Azure dominate; Terraform, GitHub Actions/Azure DevOps, Kubernetes.

Security: SOC2/ISO‑27001 experience is common; blue‑team pipelines improving.

3.2 Project archetypes we see most

Legacy modernization for U.S. enterprises (finance, legal tech, logistics, healthcare).

Greenfield MVPs for SaaS scale‑ups requiring fast “build‑measure‑learn” plus an upgrade path to scale.

QA automation platforms replacing manual regression with coverage gates in CI.

Data platform builds (governed lakehouse; BI ops; real‑time events).

Cybersecurity uplift (pipeline hardening, SAST/DAST, secret management).

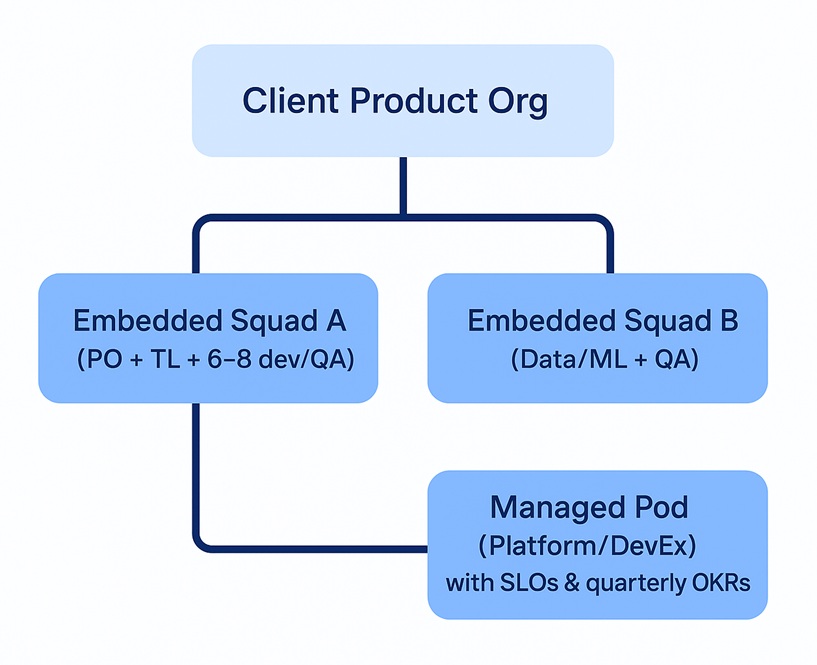

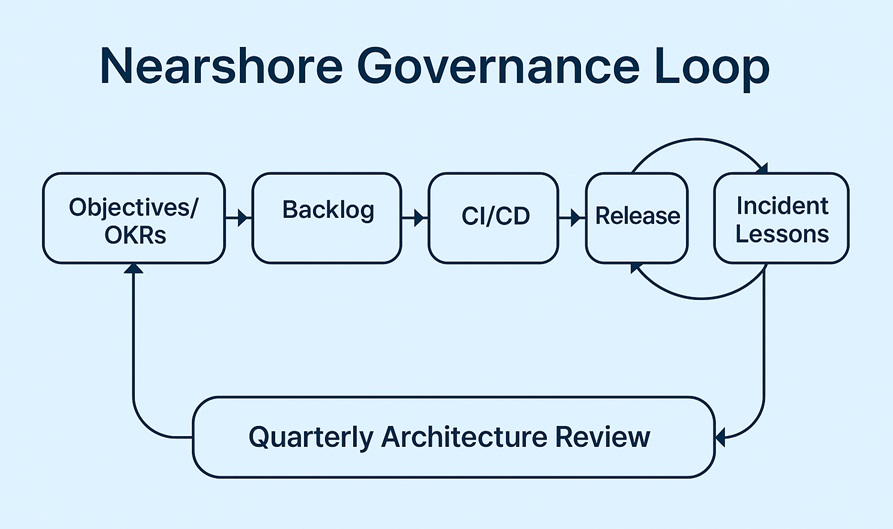

3.3 Delivery model & governance

Costa Rican nearshore vendors commonly deliver via product trios (PM/PO + Tech Lead + Design/QA) organized into 6–10 person squads. Engagements often blend embedded roles (augment client teams) and managed pods (owning roadmap slices). Retention is supported by career ladders, English/leadership programs, and rotations across domains.

Diagram — Nearshore Delivery Topology

4) Life‑Sciences, Semiconductors, and the Broader Tech Fabric

4.1 MedTech momentum

Costa Rica’s medical‑device cluster has scaled to world relevance. Major players — Boston Scientific, Johnson & Johnson MedTech, Edwards Lifesciences, among others — continue to expand production footprints and shared‑services hubs. The sector’s multiplier effects (supplier networks, quality culture, regulatory literacy) benefit software and data roles across the ecosystem.

Implications for software: regulated‑product discipline spills into engineering culture: validation, traceability, documentation, and test coverage are valued. Many engineers rotate between MedTech and fintech/insurance projects, raising the baseline for quality and compliance.

4.2 Semiconductors: consolidation and resilience

Costa Rica hosted semiconductor assembly/test (ATM) lines alongside engineering and design roles. In mid‑2025, selected packaging/test operations announced consolidation to Asia as part of global restructuring cycles. Importantly, engineering, corporate services, and R&D‑adjacent functions remain in the country, and cross‑sector hiring has absorbed part of the impact. The net effect for software: available senior talent with manufacturing‑grade rigor.

4.3 Shared services & corporate tech hubs

Beyond MedTech and chips, Costa Rica retains deep benches in corporate IT, cloud operations, finance IT, and cybersecurity within multinational shared‑services centers — a ready source of senior contributors, SREs, and business‑savvy product owners for nearshore teams.

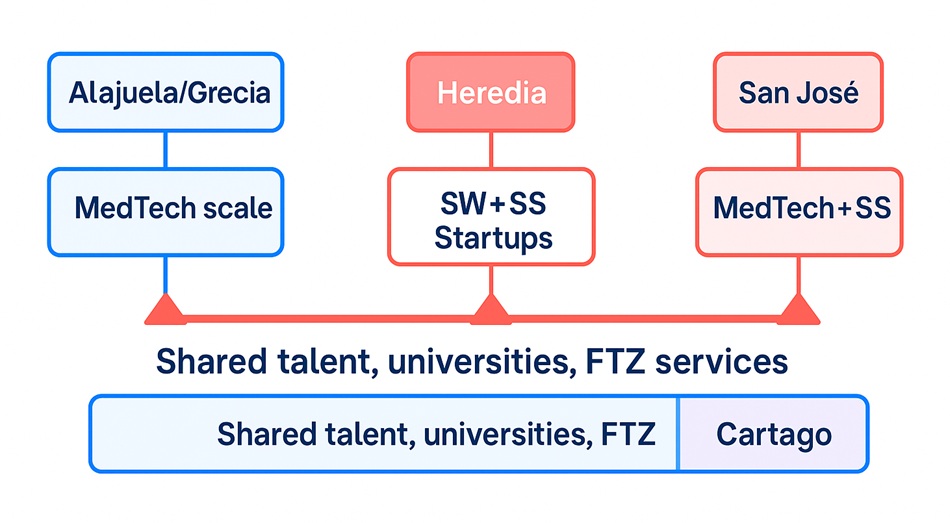

5) Geographic & Cluster Hotspots

Heredia: Dense FTZ parks; large concentration of software, shared services, and MedTech.

Alajuela (El Coyol / Grecia): Manufacturing scale (MedTech) plus support functions and growing corporate hubs.

Cartago (La Lima): Expanding life‑sciences footprint; new shared services and R&D in proximity.

San José metro: Startups, consultancies, and financial institutions; strong senior talent market.

Diagram — Tech & Services Corridor (schematic)

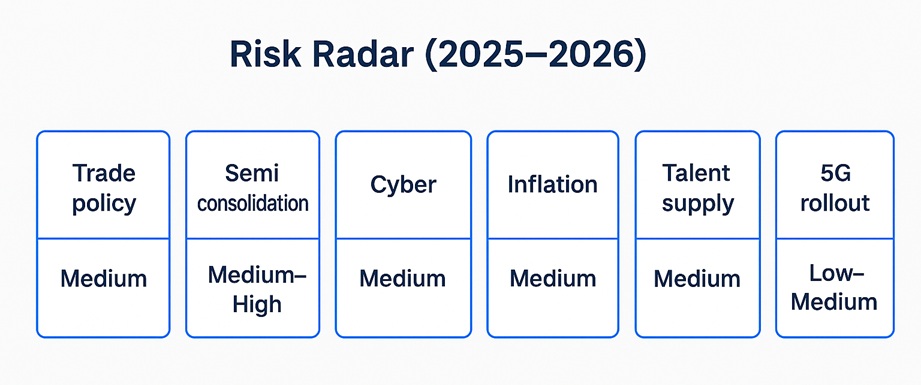

6) Risk Outlook (and What It Means for Software Leaders)

1) Global consolidation in semiconductors

Chipmakers are streamlining global assembly/test footprints. Costa Rica’s engineering roles remain sticky, but leadership teams should monitor supply‑chain knock‑ons and use them as opportunities to hire seasoned engineers transitioning from manufacturing to software/SRE.

2) U.S. trade policy uncertainty

Discussions around U.S. tariffs on critical health products create planning noise for MedTech exporters. This could influence hiring cadence and vendor budgeting in the short term but is unlikely to dent the country’s long‑term software/services fundamentals.

3) Cyber resilience

After the 2022 wave of attacks, institutions have been hardening. Vendors with ISO‑27001/SOC2 and strong incident‑response playbooks should be prioritized, with tabletop exercises included in MSAs/SOWs.

4) Talent supply vs. demand

With life‑sciences expanding, competition for bilingual senior engineers persists. The best defense is compelling career ladders, meaningful product ownership, and modern developer experience (DevEx).

7) Case Studies

Case Study A — Modernizing a .NET Platform for a U.S. LegalTech

Context: A U.S. legal software provider needed to modernize a decade‑old .NET monolith into a modular, secure, cloud‑ready platform.

Team: 1 PM/PO, 1 .NET Staff Engineer, 3 Senior Full‑Stack (.NET + React), 1 QA Automation, 1 DevOps (Azure), all in Costa Rica.

Approach: Strangler‑fig pattern; DDD‑aligned bounded contexts; zero‑downtime migrations; Playwright suites in CI; IaC with Bicep + GitHub Actions; staged rollout with feature flags.

Outcomes (12 months): 40% faster release cadence; 28% lower infra spend; severity‑1 incidents reduced from 6/quarter to 0–1; SOC2‑aligned controls implemented.

Case Study B — QA Automation Factory for a Fintech Scale‑up

Context: Rapid product expansion created regression pain and weekend hotfixes.

Team: 1 QA Lead, 3 SDET (TypeScript/Playwright), 1 Data QA, 1 SRE; embedded with client squads.

Approach: Test pyramid re‑balancing; contract tests on critical APIs; synthetic monitoring; flaky‑test quarantine; coverage dashboards.

Outcomes (9 months): Mean time‑to‑detect dropped 70%; escaped defects down 55%; developer NPS +23 points.

Case Study C — Data Platform for a Healthcare Analytics Provider

Context: HIPAA‑sensitive claims feeds across 25 sources; need for governed analytics and near‑real‑time insights.

Team: 1 Product trio + 6 data engineers + 1 MLOps; Costa Rica‑based with periodic U.S. on‑sites.

Approach: Lakehouse (Delta) with dbt; data contracts; PII tokenization pipeline; BI ops; MLOps with model registry.

Outcomes (10 months): 3× faster cohort analytics; auditability for payers; 99.9% SLA for nightly pipelines.

Note: Client names confidential; outcomes and architectures reflect Near Coding program experience with U.S. enterprises.

8) How Costa Rica Compares to Other Nearshore Options

Versus Mexico: Mexico offers sheer talent volume and some lower costs in non‑Tier‑1 cities. Costa Rica outperforms in English density per capita, political stability, and MedTech/quality culture spillovers.

Versus Colombia: Colombia has vibrant dev communities and strong design/UX. Costa Rica has a higher proportion of bilingual seniors and tighter time‑zone alignment for Central Time workflows.

Versus Argentina/Chile: Southern Cone markets deliver senior depth but face FX/policy volatility. Costa Rica offers steadier policy and FTZ predictability.

Bottom line: For regulated and quality‑critical products, Costa Rica’s value per shipped feature remains compelling.

9) Practical Playbooks for U.S. Engineering Leaders

9.1 Launching an Embedded Nearshore Squad (90‑Day Plan)

Days 0–15

Define business outcomes (lead time, quality, re‑platforming milestones).

Select vendor; align on governance (OKRs, SLOs, comms cadence).

Approve security baseline (SSO, secrets, SBOM, incident playbooks).

Days 16–45

Staff roles; establish environments; connect observability (logs/traces/metrics).

Baseline tests & delivery metrics; ship “hello‑feature” to production.

Days 46–90

Expand CI/CD gates; enable feature flags; harden on‑call rotation.

Run joint architecture review; publish Q2 roadmap with capacity model.

9.2 Retention & Developer Experience (DevEx) Tactics

Career ladders with tech‑lead/staff tracks.

10% time for platform improvements (linting, pipelines, test infra).

Learning budgets (English, certifications), rotations, and conference talks.

Transparent compensation bands; bonuses tied to shipped outcomes, not vanity metrics.

9.3 Vendor Scorecard (Checklist)

Talent: English levels; senior ratio; MedTech/regulated experience.

Delivery: CI/CD maturity; test coverage and flake rate; DORA/SPACE metrics.

Security: ISO‑27001/SOC2; SBOM/signing; incident response MTTR targets.

Governance: OKRs; roadmap hygiene; on‑site/overlap policies; executive access.

10) Visual Diagrams for Stakeholders

10.1 Costa Rica Software‑Services Value Chain (simplified)

10.2 Nearshore Governance Loop (delivery health)

10.3 Risk Radar (2025–2026)

11) Recommended Actions for Companies in 2025

Choose vendors with regulated‑domain DNA for healthcare/fintech; ask for validation/test artifacts up front.

Codify bilingual collaboration (definition of ready/done, ADRs, PR templates) to eliminate rework.

Adopt value‑based pricing (per outcome) where scope is well‑defined; use capacity pricing for discovery.

Lock security baselines (SSO, MFA, secret scanning, container scanning, SBOMs, dependency review) before sprint 1.

Plan talent sustainability: reserve training budget and career‑path slots to retain seniors; rotate staff to avoid burnout.

Leverage Costa Rica’s time zone: increase pair‑programming windows and same‑day PR turnaround.

12) Curated Quotes (human voices)

“Costa Rica has great potential for the development of the health sector, and collaboration between the public, private and academic sectors is essential.” — Gloriana Lang, CINDE

“In Costa Rica, more than 99% of the electricity from the public utility comes from renewable sources.” — Edwards Lifesciences Corporate Impact Report

“High‑tech products are a growing share of Costa Rica’s exports.” — OECD Economic Survey, 2025

“The Free Trade Zone regime is available to national and foreign companies seeking to develop operations in the country.” — PROCOMER FTZ Guide

“The company plans to consolidate test operations in Costa Rica to sites in Vietnam and Malaysia.” — Intel announcement (2025)

(Short quotes shown for readability; full references provided in the Sources section below.)

13) Sources & Further Reading

EF English Proficiency Index (Costa Rica fact sheet, 2024).

OECD Economic Survey of Costa Rica (2025).

PROCOMER — Free Trade Zone Guide (2025).

U.S. State Department — Investment Climate Statement: Costa Rica (2024).

WIPO / USITC — Costa Rica’s medical device industry briefs (2024).

CINDE — sector news on FDI, MedTech, and corporate services.

Intel restructuring announcements (2025).

National AI Strategy (2025) and National Cybersecurity Strategy (2023).

Central Bank of Costa Rica (BCCR) — GDP by activity; 5G auction notes via OECD.

Recent press on potential U.S. medical‑device tariffs (2025).

14) About Near Coding — Why Partner with Us

Near Coding builds high‑performing bilingual squads in Costa Rica for U.S. enterprises and funded scale‑ups. We specialize in Microsoft Technologies with an Agile approach, data/ML pipelines, and QA automation for regulated, high‑reliability environments. Engagements range from embedded staff augmentation to outcome‑based pods.

Contact: info@nearcoding.com

HQ: San José, Costa Rica

Let's talk about your next project

Near Coding

Nearshore Software Services Partner

Service oriented, cost-effective, reliable and well-timed specialized in Software Development and located in Costa Rica